Should the wealthy pay higher taxes?

January 17, 2020

According to a report published by Oxfam, a charitable organization focusing on the alleviation of global poverty, in 2019, the 26 richest individuals in the world owned as much wealth as the bottom half of humanity, which is about 3.8 billion people. Higher tax rates on the wealthy would reduce inequality and allow funding for free college tuition and healthcare plans.

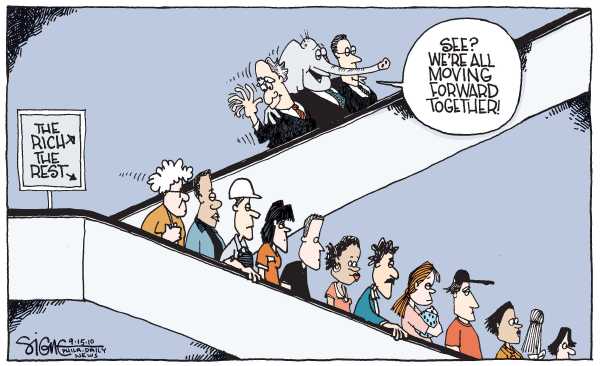

Inequality in the United States has been around since it’s creation; one of the ways we observe inequality today is taxes. Increasing the tax rate on wealthy Americans is policy idea with historical precedent. The United States had much higher tax rates for the wealthy for most of the 20th century until companies found ways to dodge them and politicians cut taxes that fell heavily on the rich causing the burden to fall on the middle class. The only reason for cutting these taxes was to benefit the economy, but this justification was wrong. The wealthy, not the economy, but the wealthy, are the only ones who have benefited from those tax cuts.

Many politicians have offered up policies that would tax the wealthy. Representative Alexandria Ocasio-Cortez proposed a plan to nearly double the income tax rate on top earners. Under her plan, the rich would pay a tax rate of 70 percent of income over 10$ million. However, this plan is very ambitious and a little overdone for many politicians taste. Senator Elizabeth Warren, a candidate for president, proposed taxing not just large incomes but also accumulated wealth. This plan would tax the richest 75,000 American households and is estimated to bring in $3.75 trillion to the US government over ten years. Again, not everyone is in love with the idea, but Warren’s plan is essential because it levels the field and the middle class wouldn’t be picking up the slack of the wealthy.

Free/reduced college tuition and healthcare are big topics covered in modern day politics. The question on many Americans’ minds refers to how we are going to pay for that. The answer is simple – a tax on the wealthy. Alleviating the massive amounts of debt due to healthcare costs or college seems like a pipe dream until you look at the facts and realize it can totally be done. By going through with a wealthy tax, the funds for these ambitious plans are there.

The people who oppose these plans, either the rich or people who don’t like to look at the facts, argue that high tax rates would stifle economic activity. However, the proof is in the pudding; it has been done before. It worked, so the question now is: why aren’t we making the rich do their part?